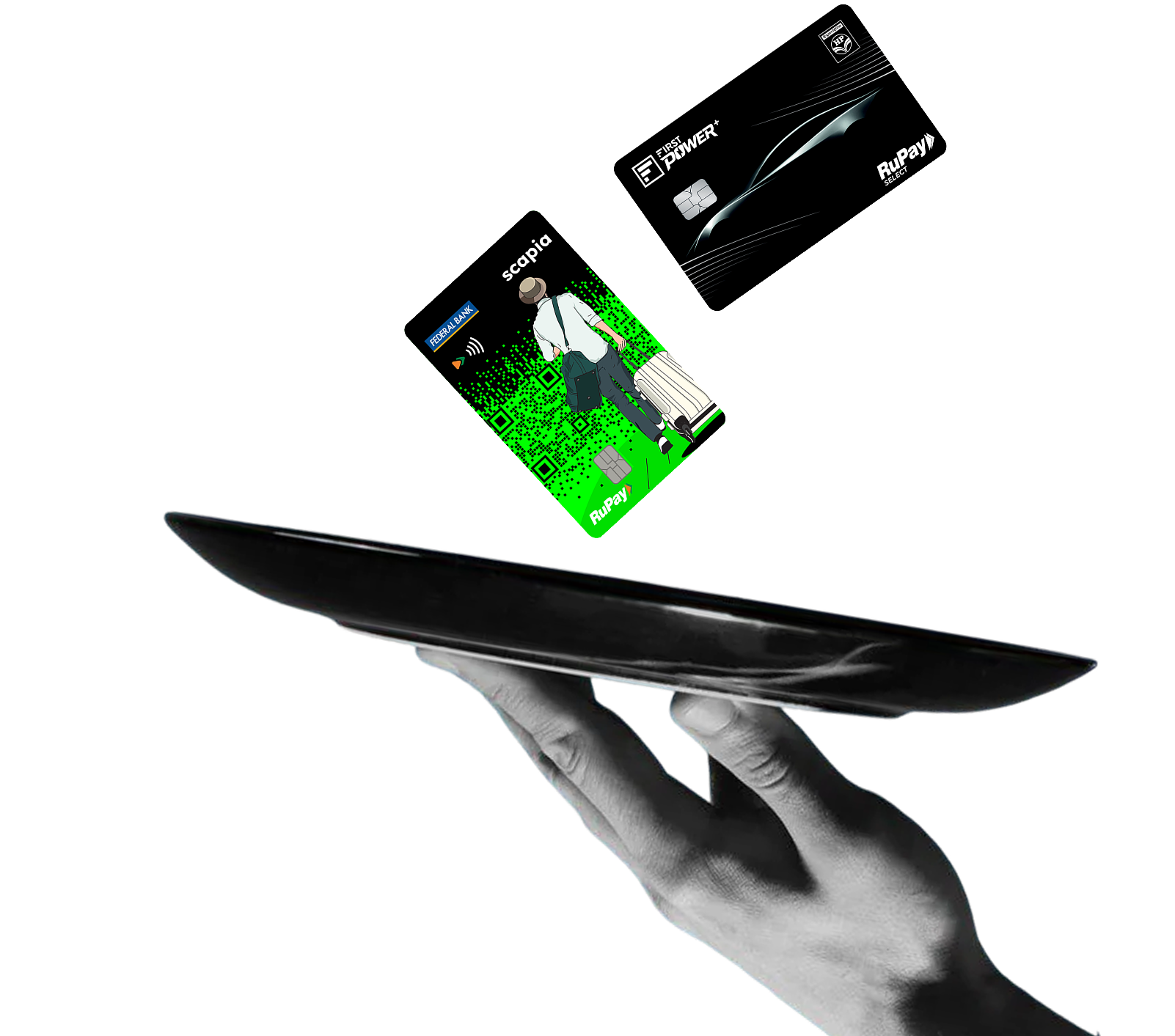

A curated selection built to match your lifestyle. Compare effortlessly. Choose confidently.

Browse through the features & choose the one that truly complements you.

%201.png)

Refyne is Asia’s largest financial wellness suite that offers employees access to funds, learning material on improving personal finance, and tools for planning long-term financial health. Refyne was built to empower modern Indian working individuals to strengthen their financial awareness and goals for long-term financial security.

With Refyne’s app, employees can solve issues such as the mid-month cash crunch, unexpected expenses, and medical emergencies which contribute to the rise of stress in the workforce. By integrating with Refyne, organisations can improve employee engagement and satisfaction, as well as productivity at their workplace. To find out more about Refyne’s offerings, please contact us here.

Refyne’s Salary On-Demand offering helps employees access their salary before payday. For larger monetary needs, the Refyne app allows borrowings after certain eligibility checks. There are pre-qualification checks in place for employees planning to avail mid to long-term credit.

A small slab-based convenience fee is charged to the employee based on the transaction amount. With personal or payday loans, however, an interest is charged on the overall credit utilised, in addition to handling charges, documentation charges, and more.

Once we sign the agreement with the organisation, Refyne can extend the financial wellness benefits in as few as 24 hours with our base model. However, we have a slew of integrations to support different models of go-live. This allows Refyne to launch the benefits within 3 to 10 days depending on the customisations required by your company.

Yes. Refyne follows RBI’s guidelines for mandatory KYC. This makes for seamless movement of funds to and from your employees' accounts, and allows them to access all the features of the Refyne App.

Over and above this, please be assured that we follow DPDP, VAPT, Labor Laws, and other RBI ordinances as they emerge, in addition to SOC-2, and ISO27001 compliances. Refyne is trusted by over 500 corporations. Your employee details are safe with us.

Refyne’s suite integrates directly with your HRMS to access relevant information. Short-term withdrawals are directly deducted from the payroll of that month if the employee accesses a part of their accrued salary from the app.

For larger amounts and tenured loans, the instalments are calculated and automated so that they are featured as deduction statements in the respective month's payroll. These line items are marked out clearly for your payroll team to review. Your payroll structure and cadence will not be affected in any way at all.

Payroll deductions are reflected directly in your HRM systems as marked line items. They do not burden your payroll further, as the fully automated system shows you the correct amount at a glance.

Knowing that the employer has added a salary advance amenity gives additional reassurance to the employees, especially in their time of need. We preserve this while making sure the repayment comes in time without impacting the salary credit timelines and pay periods.

Refyne’s financial wellness suite differs from the banking app in that it doesn’t require the user to have a credit score to access liquidity or learn about personal finance.

Refyne’s suite is unique in the way it is available to users on the go, on a multitude of devices, and with options to sign up for 1-1 expert sessions. All of these can happen without a user having to visit a bank branch; however, it does offer bank-grade security.

The Refyne App sees notably high usage at night - a time when bank cash counters are unavailable. This is a huge advantage in the face of emergencies. The app ensures 24x7 availability without users having to wait for credit approvals or deal with the bureaucracy or delays generally associated with banking procedures.

In addition, Refyne is available in 11 regional languages. Financial concepts and terms are explained in simple terms under the Money Guru product of financial literacy.

The newly introduced employee purchase program is called the Refyne Privilege Club. These benefits include heavy discounts on select electronics and gadgets, with a host of seasonal offers, and discounts without the need for any vouchers or coupons. The idea is to help employees make planned purchases, avail discounts, optimise savings and reach their financial goals quicker.